Irish Payroll Services

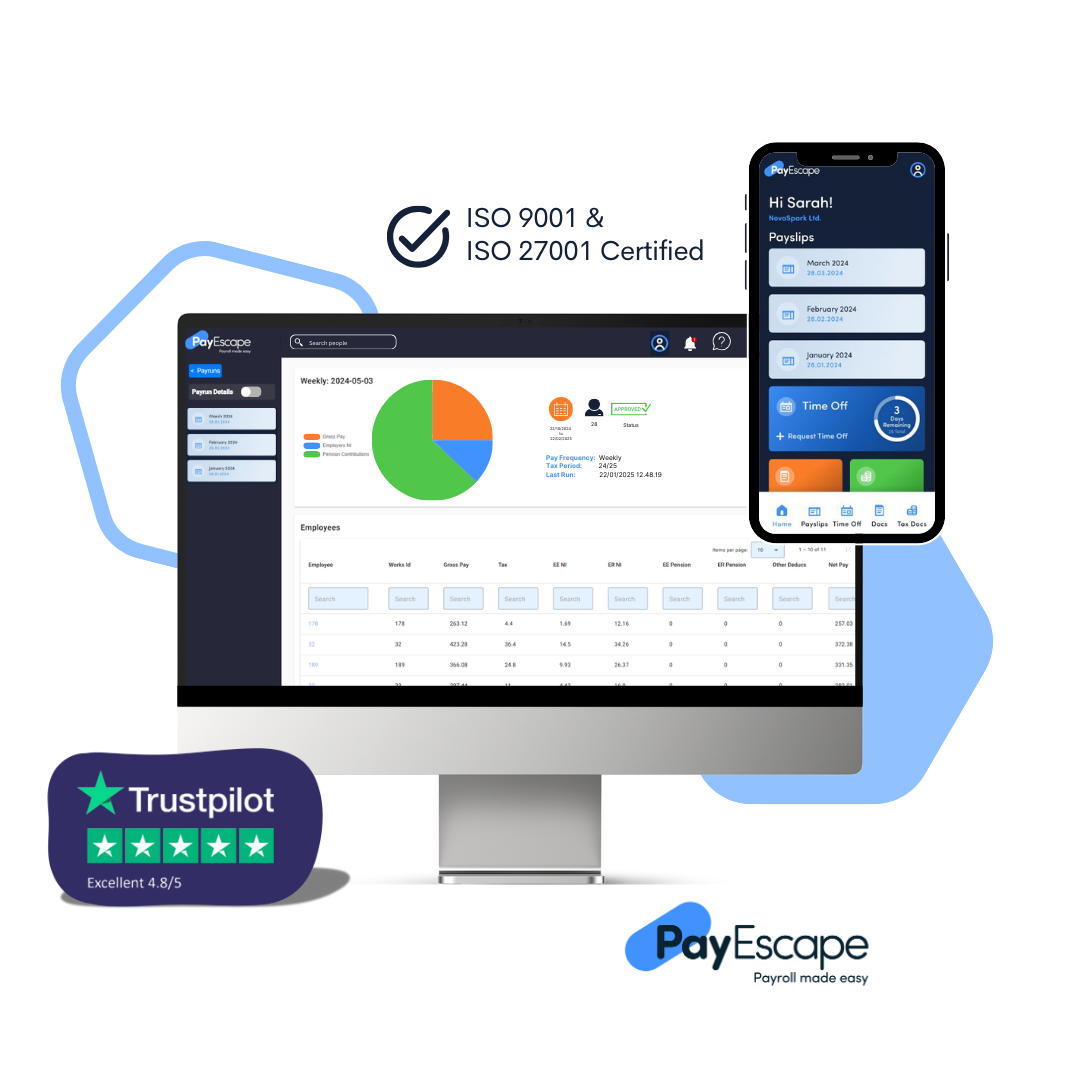

PayEscape is swiftly becoming one of Ireland’s premier choices for Payroll software and services. Our cloud-based technology, combined with 5* customer service is transforming how Irish businesses manage their payroll.

PayEscape is swiftly becoming one of Ireland’s premier choices for Payroll software and services. Our cloud-based technology, combined with 5* customer service is transforming how Irish businesses manage their payroll.

5* Service & Support

Fully Managed Software

ISO 27001 Certified

HMRC Recognition

BACS Approved

As a leading outsourced payroll provider for Irish businesses, we provide accurate and timely payment processing for your employees, along with comprehensive compliance management.

With no contractual obligations, our in-house team of CIPP experts handle all payroll-related tasks, offering your business unparalleled peace of mind.

From startups to enterprises, businesses of all sizes require efficient payroll solutions. PayEscape’s versatile payroll solution caters to the unique needs of businesses across various industries and scales, facilitating seamless payment management regardless of your company’s size or sector.

Our Irish payroll solutions differ to the UK, find out what’s included in our services below.

Expense management

ROS Connected

Email System

Multi-user functionality

Customise your notifications

Self Service Software

"*" indicates required fields

Using our cloud-based software we manage all aspects of your payroll process. From calculating your payroll taxes and filing with HMRC to managing all components of auto enrolment and so much more. Whether it’s reimbursement or pre-tax benefits we’ve got it covered.

Our HR platform lets you manage all aspects of your HR administration. With HR Escape can approve and monitor holiday, record working time and calculate wages, allocate time and staff expenses to clients, projects, and activities, and much more.