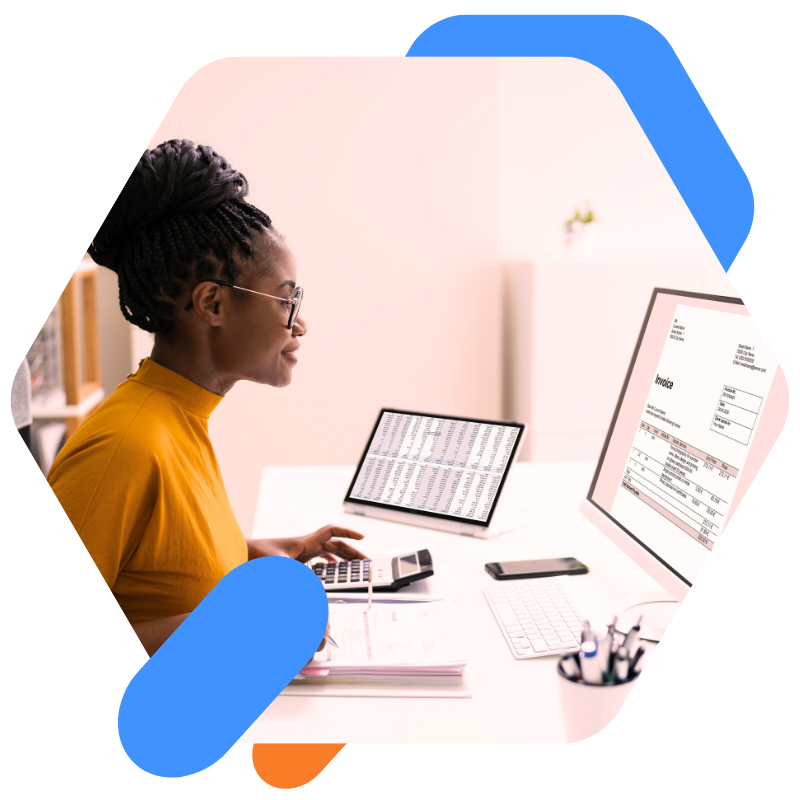

Increased efficiency and accuracy

Accountancy payroll software automates many of the repetitive tasks that accountants typically handle, such as calculating wages, tax deductions, and generating payslips. Automation reduces the likelihood of human error, ensuring that payroll calculations are accurate and compliant with current tax regulations. This efficiency allows accountants to focus on more strategic tasks, such as financial planning and advising clients.

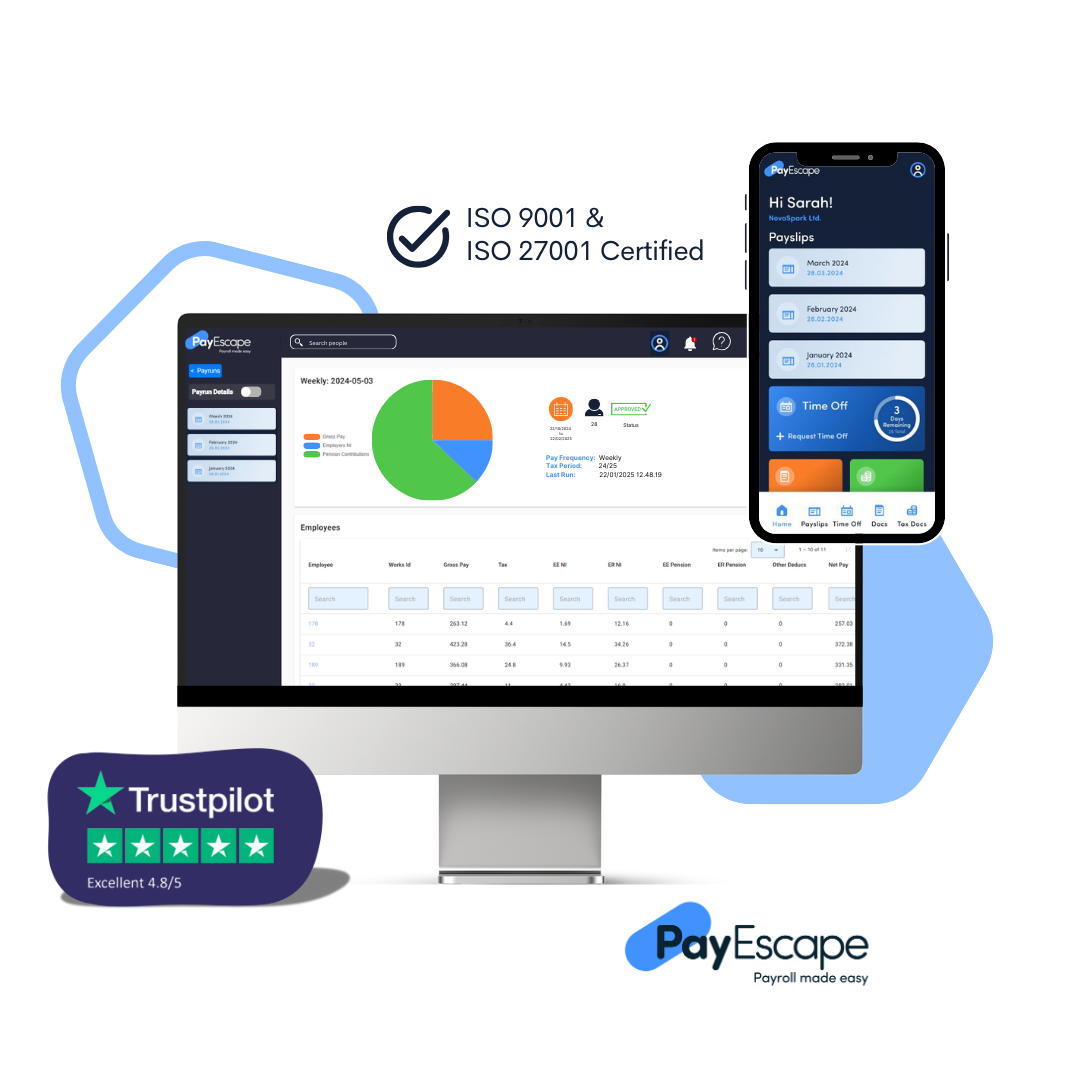

Compliance and security

Payroll software ensures compliance with tax laws and labour regulations, which can be complex and frequently updated. The software automatically updates to reflect changes in legislation, reducing the risk of non-compliance penalties. Additionally, it offers robust security features, such as encryption and secure data storage, to protect sensitive employee information from data breaches and unauthorised access.

Seamless integration with accounting systems

Payroll software designed for accountants integrates seamlessly with accounting systems, streamlining the flow of financial data. This integration reduces the need for manual data entry, minimising errors, and ensuring that financial records are always up-to-date. It also facilitates comprehensive reporting and analysis, enabling accountants to provide more insightful financial advice to their clients.