Choose Cloud-based Payroll Software

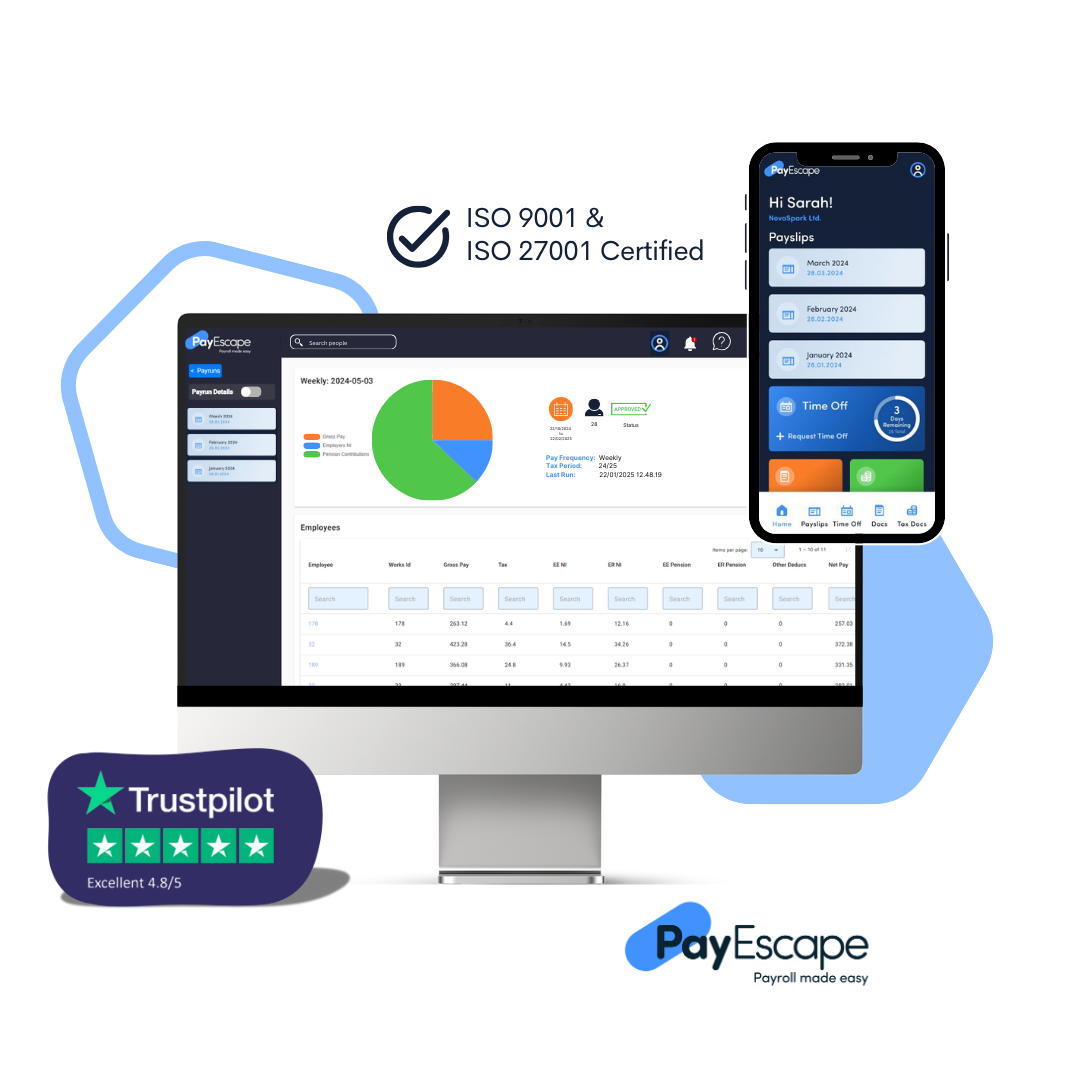

with PayEscape

PayEscape’s cloud-based payroll software is packed with features designed to streamline payroll management and improve overall business operations:

Compliance Management:

Staying compliant with tax laws and labour regulations is critical for any business. PayEscape’s software is designed to keep you compliant by automatically updating with the latest laws and regulations. It also provides tools for managing employee benefits, tracking hours worked, and generating compliance reports.

Integration with HR and Time Management

PayEscape’s payroll software seamlessly integrates with the company’s cloud-based HR software and time management solutions, creating a unified platform for managing your workforce. This integration eliminates the need for duplicate data entry and ensures that your payroll, HR, and time management systems are always in sync.

Dedicated Customer Support

PayEscape is committed to providing exceptional customer service. Our UK based team of CIPP certified payroll experts are available to assist with any questions or issues you may encounter, ensuring that your payroll processes run smoothly.