Payroll Solutions for Retail

Managing payroll in the retail sector presents unique challenges. From part-time staff to fluctuating seasonal demands, payroll management must be efficient, accurate, and compliant with regulations.

Managing payroll in the retail sector presents unique challenges. From part-time staff to fluctuating seasonal demands, payroll management must be efficient, accurate, and compliant with regulations.

As an employer, it’s essential to have a reliable payroll solution that not only processes payments but also ensures compliance with the latest UK employment laws.

Accurately handling payroll for various teams in the retail sector is essential for not only preventing costly mistakes, including minimum wage laws, tax deductions, and pension contributions.

5* Service & Support

Fully Managed Software

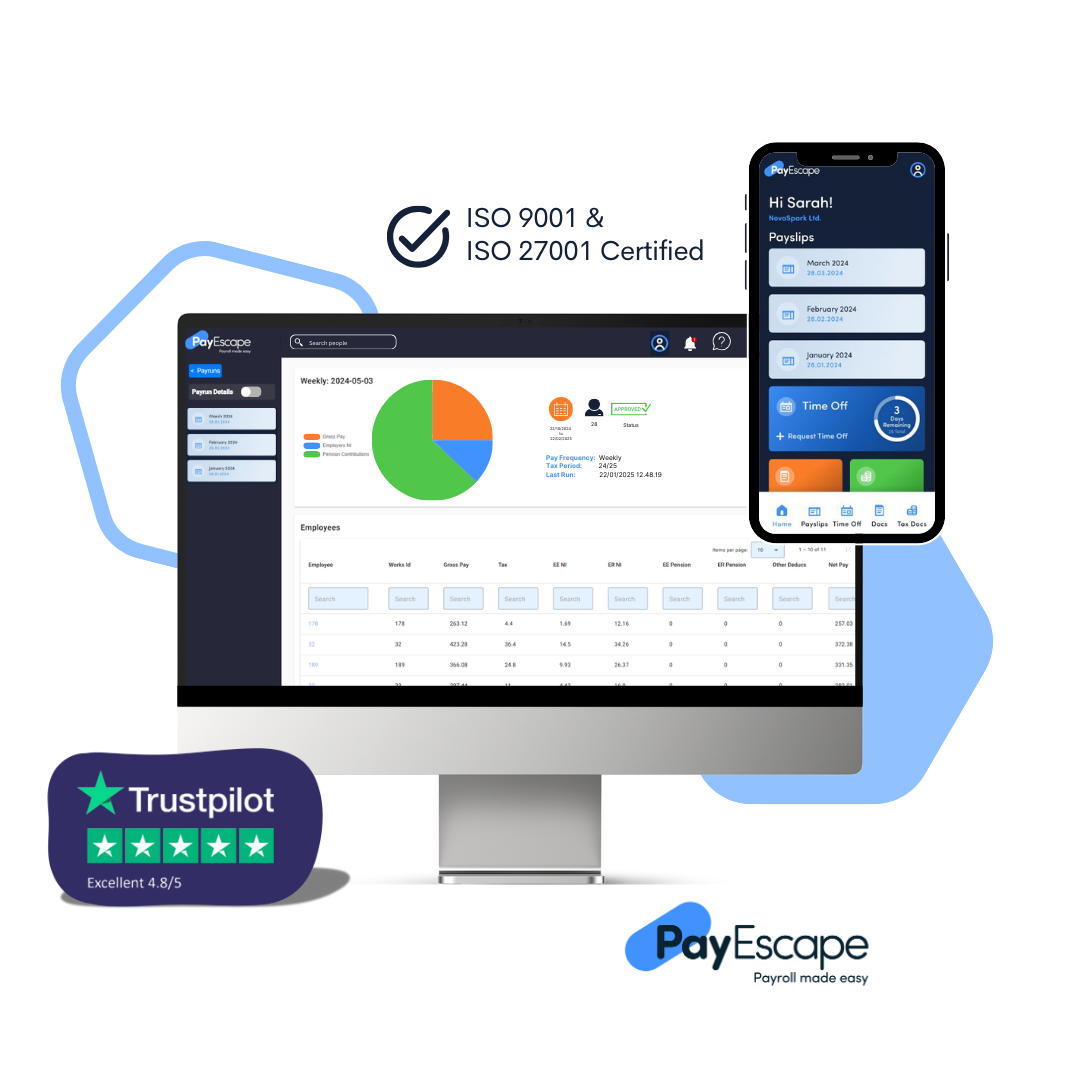

ISO 27001 Certified

HMRC Recognition

BACS Approved

Payroll processes are important for retailers as they ensure staff are paid accurately and on time, help maintain legal compliance to avoid fines, and support employee satisfaction meaning they are paid on-time and correctly. Errors in payroll can create mistrust among employees, reduce productivity, and may even lead to legal action.

Cloud-based payroll software operates by utilising cloud computing technology.

Opt for a fully managed payroll service by outsourcing the entire payroll process to PayEscape

PayEscape’s integrated HR and payroll software combines powerful HR functionality with robust payroll capabilities.

Investing in payroll software specifically designed for retail automates many time-consuming tasks and reduces errors:

Need help to understand what solution is best for your business?

Managing human resources alongside payroll can be challenging, especially in the fast-paced retail sector with new hires and short term contractors on a regular basis. Retailers often face high staff turnover, seasonal recruitment, and varying work patterns. Integrating HR with payroll software can streamline the management of both processes.

In the retail sector, staying up-to-date with UK payroll laws is essential for compliance and avoiding penalties. Key areas for retailers include:

Retailers must pay employees the appropriate rate based on age and employment type. As of April 2024, the NLW applies to all workers aged 21 and over, with increases planned to meet 67% of median pay by 2025. The current NLW is £11.44, with projections suggesting an increase to approximately £11.89 in 2025, depending on economic conditions.

All retail employees, whether full-time, part-time, or zero-hour, are entitled to holiday pay based on their average weekly earnings and hours worked over the last 52 weeks. It’s essential to calculate this accurately to comply with UK law and avoid disputes. HMRC frequently updates its guidance, so retailers should regularly review HMRC’s official resources to maintain compliance and address any sector-specific obligations they may face.

Retailers must automatically enrol eligible employees in a workplace pension and make regular contributions. The minimum contribution requirement remains at 8% of qualifying earnings, with the employer contributing at least 3%.

Employers are responsible for accurate tax and NIC deductions from employee wages, which must then be submitted to HMRC. Recent government adjustments, like NIC rate cuts in 2024, may affect payroll costs, but retailers must ensure they follow the latest guidance to remain compliant.

By choosing the right payroll software and systems, retailers can streamline their payroll processes, reduce errors, and focus on growing their business. Switch to PayEscape’s payroll software for your business and experience payroll solutions designed to meet the specific needs of your sector with the tools needed for seamless payroll and HR management.

"*" indicates required fields

Using our cloud-based software we manage all aspects of your payroll process. From calculating your payroll taxes and filing with HMRC to managing all components of auto enrolment and so much more. Whether it’s reimbursement or pre-tax benefits we’ve got it covered.

Our HR platform lets you manage all aspects of your HR administration. With HR Escape can approve and monitor holiday, record working time and calculate wages, allocate time and staff expenses to clients, projects, and activities, and much more.