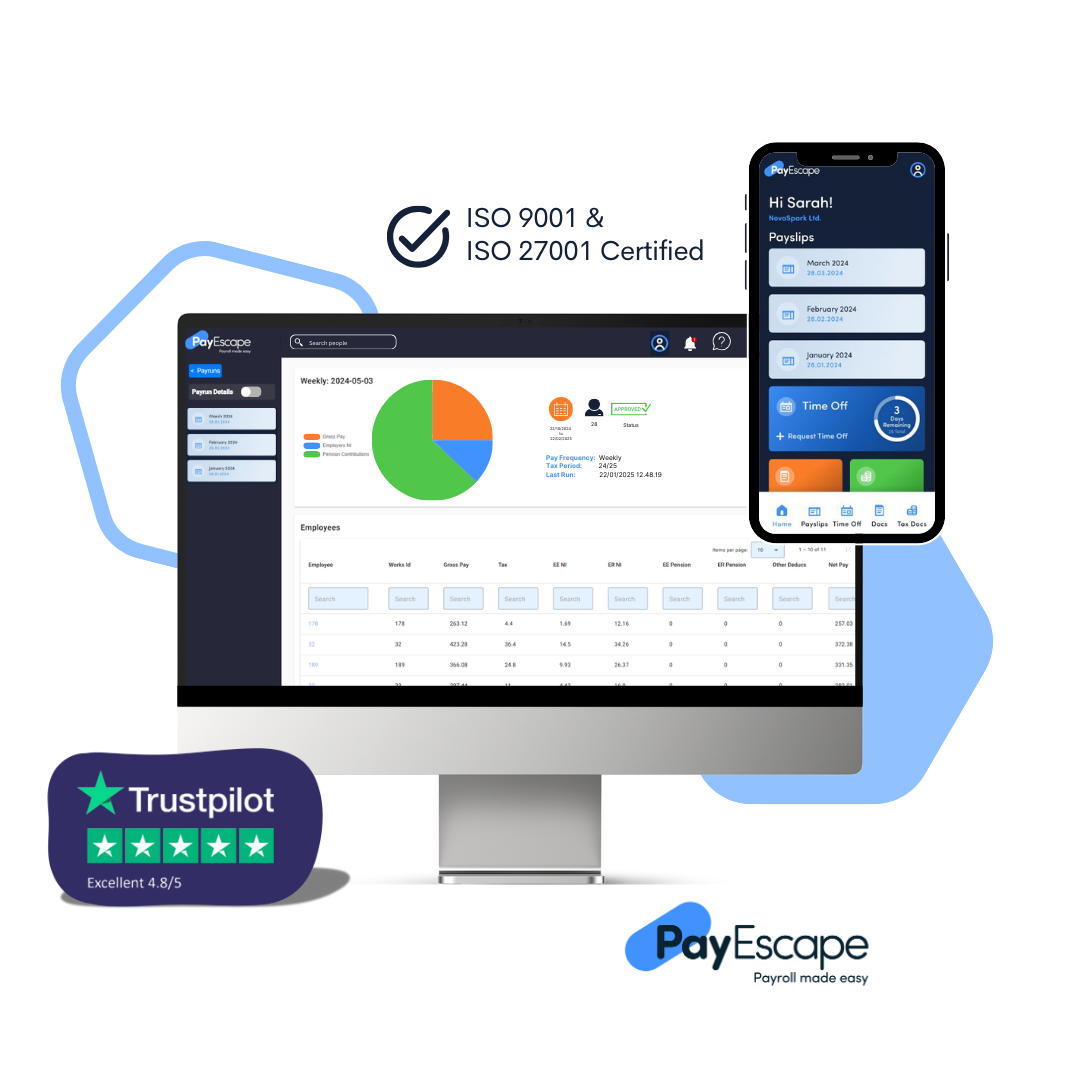

Manufacturing Payroll Solutions

Managing payroll for a manufacturing business can be challenging especially with a high volume of employees. PayEscape’s Manufacturing Payroll Software simplifies the process, ensuring accuracy, compliance, and efficiency.