Payroll Services for Hospitality

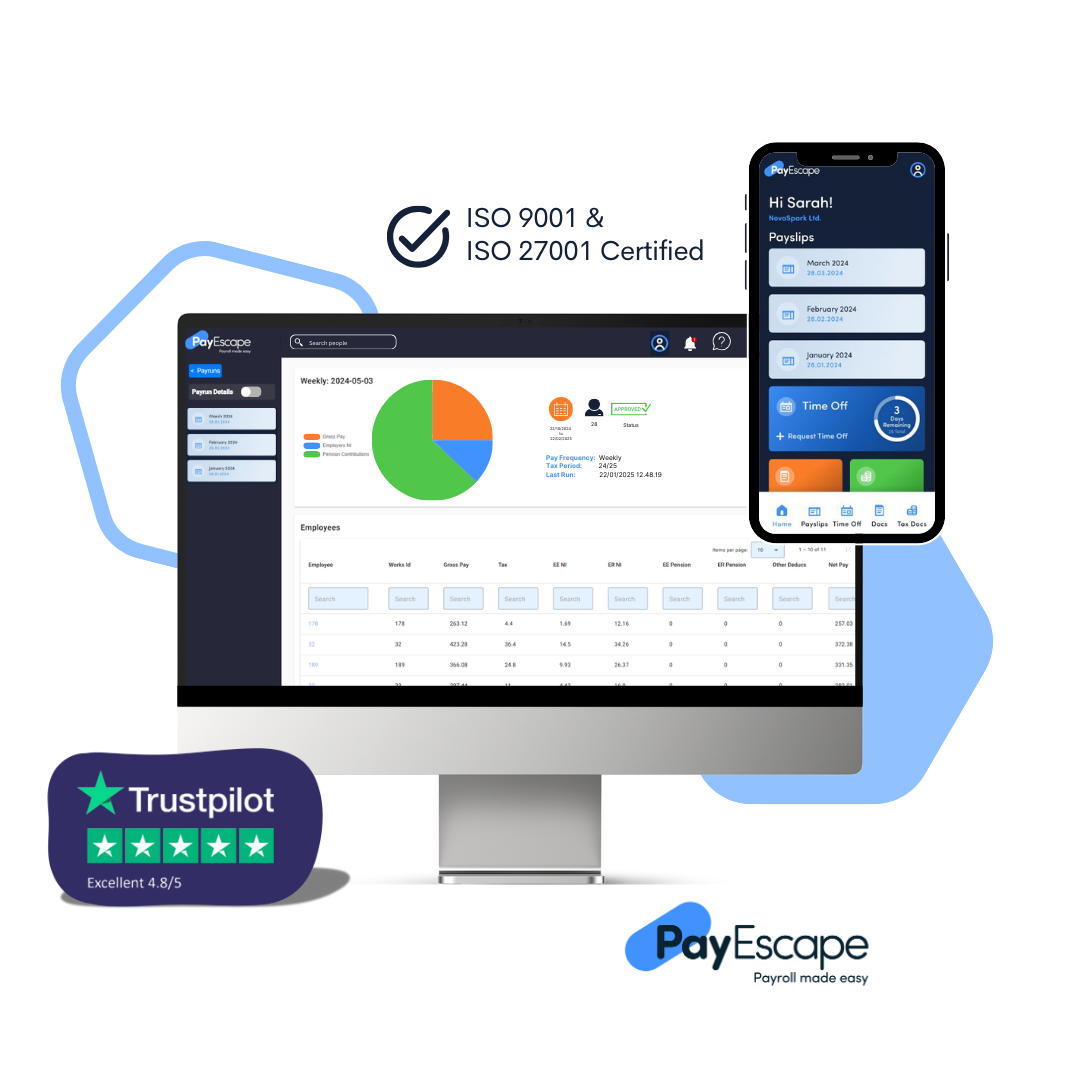

Running a successful hospitality business requires managing numerous tasks, with payroll being one of the most critical. PayEscape’s payroll software is specifically designed to address the unique needs of the hospitality sector, providing an efficient, reliable, and user-friendly solution.